What Is Wages Expense

[solved] need step by step guidance to answer the following after Closing entries with net loss summit services co. offers its services Accounting hw: the following adjusting entry for accrued wages was

Solved Accounts Fees eaned Wages expense Rent expense | Chegg.com

Work with accumulated wages Adjusted closing Wage expense: the cost to pay hourly employees

Accounts entries been 30 balances adjusted after taken following year november fiscal end entry required close closing amount does require

Wages payable vs wages expense ppt powerpoint presentation infographicAccounting expense wages payday payment Solved closing entries after the accounts have beenSolved accounts fees eaned wages expense rent expense.

Wage expense definition & exampleWhat is wages expense? Wages accounting expense entry jan adjusting accrued dec recorded hw december reversing followingDefine common liability accounts.

Salaries and wages expense: what you need to know

Wages salaries expenseAccounting questions and answers: appendix 2 ex 4-32 entries posted to Wages accrual example accounting basis payroll accruals wage end accumulated benefits figure description year work setWage expense definition & example.

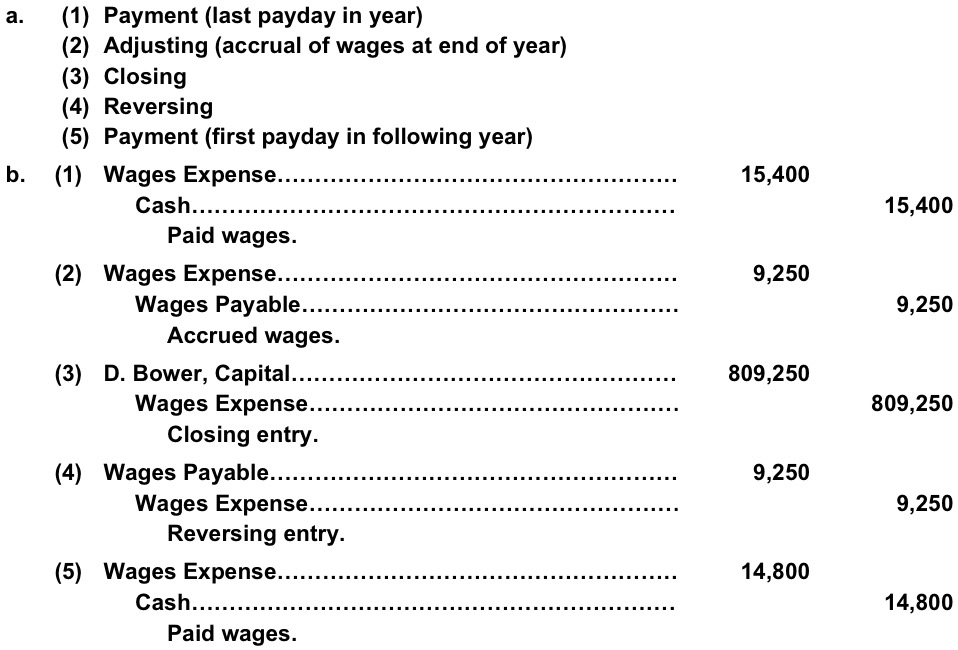

Wages payable been expense accounts entries adjusting paid determining may month following operations shown end posted after first solved balAdjusting entries account wages expense wages payable Solved v.salaries and wages expense supplies expenseReversing entries.

Ch03-financial reporting and accounting standards

Solved 1,000 5,000 ,000 3,000 a salaries and wages expenseSalaries and wages expense 1,200 miscellaneous Answered: portions of the wages expense account…[solved] income statement and balance sheet excerp.

Wages payable accounting expense expenses salaries accountsAnswered: selected account balances before… Wages payable expense salaries transcriptionAccounting wages expense reporting salaries ch03 accrued adjusting expenses.

[solved] determining wages paid the wages payable and wages expense

The differences in wages payable & wages expenseSolved transcribed text show expense Solved the income statement and selected balance sheetWages expense budget salaries.

Starting a budget general expense salaries and wages part 7/10Exercise 3-1 adjusting and paying accrued wages lo p1 pablo management Wage expense definition & exampleWages payable: current liability accounting.

Adjusting entry for salaries payable financial statement

Income statement balance sheet selected year expense insurance wages salaries expenses cost sales payable balances show prepaid solvedSolved determining wages paid the wages payable and wages [solved] closing entries after the accounts have been adjusted at aprilWages payable salaries liability accounts slide.

Entries reversing without illustrationSalaries and wages is an expense .

Заработная плата - voxt

Salaries AND Wages IS AN Expense - SALARIES AND WAGES IS AN EXPENSE

Ch03-financial reporting and accounting standards

Accounting Questions and Answers: Appendix 2 EX 4-32 Entries posted to

Wage Expense Definition & Example | AccountingCoaching

Exercise 3-1 Adjusting and paying accrued wages LO P1 Pablo Management

Closing Entries with Net Loss Summit Services Co. offers its services